Brent: The Unsung Hero Of Energy And Exploration

Hey there, folks! Let's dive straight into the world of Brent, a name that might sound familiar to you if you've ever dipped your toes into the energy market. Now, Brent isn't just some random guy you met at a bar last night. No, no, no. Brent is actually a crucial player in the global energy game, and today we're going to break it all down for you. So, buckle up because we're about to take a wild ride into the fascinating world of Brent. Get ready to learn something that could change the way you see energy trading forever.

When we talk about Brent, we're not just throwing names around like a game of catch. Brent crude oil, to be precise, is one of the major benchmarks for global oil pricing. It's like the rock star of the energy industry, and understanding its role can give you a serious edge in the market. Whether you're an investor, a trader, or just someone curious about how the world works, knowing Brent is like having a secret weapon in your arsenal. Let's get started, shall we?

Now, before we dive too deep, let's set the scene. Brent crude oil isn't just any oil. It's a specific type of crude oil that's produced in the North Sea. But don't let the location fool you. This oil is traded worldwide, and its price influences everything from gas prices at the pump to the cost of shipping goods across the globe. So, when we say Brent is important, we mean it. Let's explore why this oil is so crucial to the global economy.

Read also:Alec Knight Unveiling The Untold Story Of A Rising Star

Brent Basics: What You Need to Know

Alright, let's break it down. Brent crude oil is a light, sweet crude oil, which means it has a low density and low sulfur content. These qualities make it highly desirable for refining into products like gasoline and diesel. It's like the premium cut of steak in the energy world. But why does it matter? Well, Brent is one of the most traded commodities in the world, and its price is a key indicator of global oil market trends.

Why Brent Matters

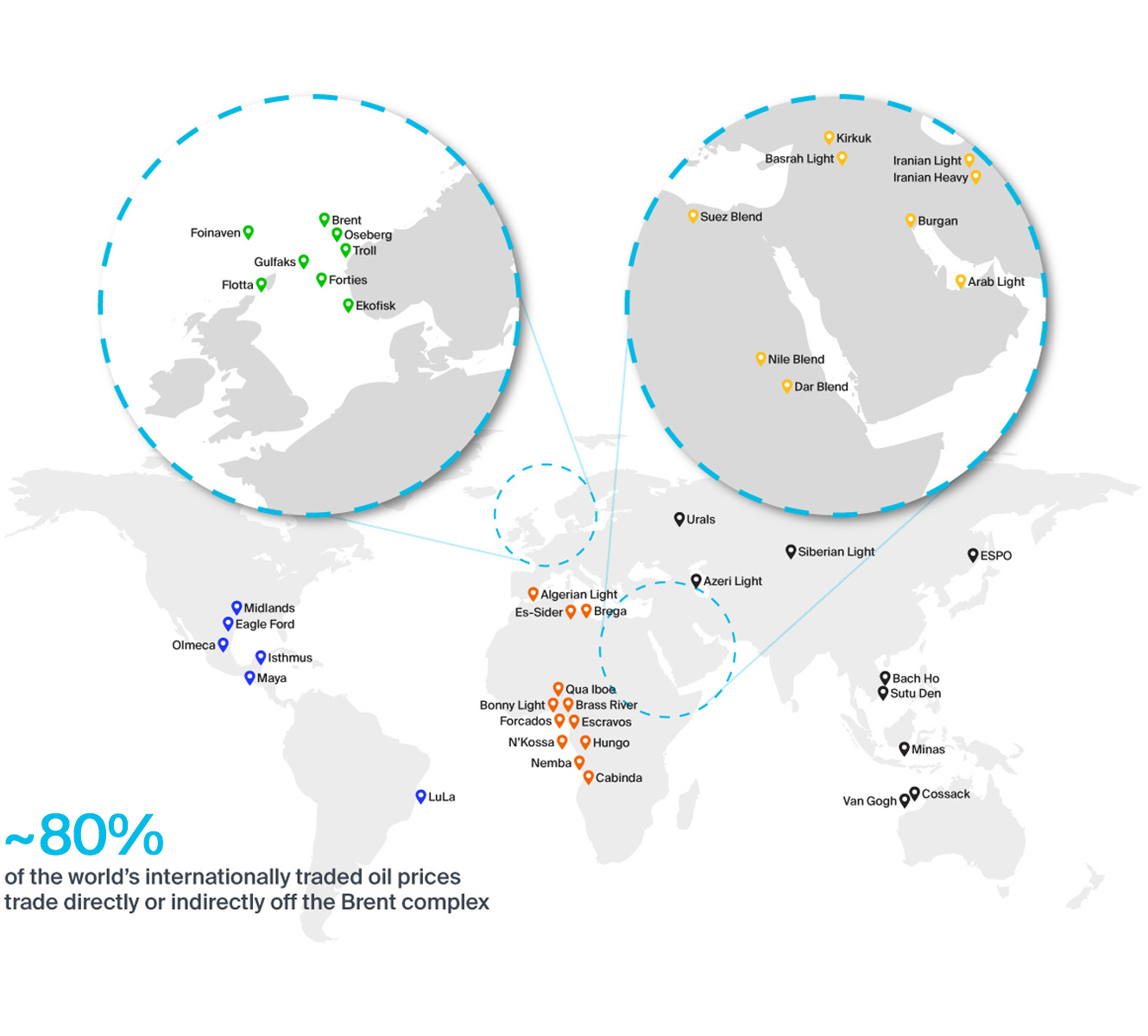

Here's the deal. Brent crude oil is used as a benchmark for pricing about two-thirds of the world's internationally traded crude oil. That's a big deal. It affects everything from the cost of heating your home to the price of a flight to your dream destination. So, when you hear about fluctuations in Brent prices, it's not just some random number. It's a reflection of the global energy market's health and stability.

History of Brent: How It All Began

Let's take a trip back in time. Brent crude oil production began in the late 1970s in the North Sea. The name "Brent" comes from the Brent oilfield, which was named after the Brent goose, a species of bird. Cool, right? Over the years, Brent has grown in importance as a global benchmark, and today it's one of the most closely watched commodities in the world. It's like the original influencer of the energy industry.

The Brent Goose: A Symbol of Energy

Who would've thought a bird could be so influential? The Brent goose, which migrates between the Arctic and Europe, inspired the name of one of the world's most important energy benchmarks. It's a reminder that even the smallest things can have a big impact. So, the next time you see a Brent goose, give it a little nod of respect. It's more than just a bird; it's a symbol of the global energy market.

Brent vs. WTI: The Battle of the Benchmarks

Now, let's talk about Brent's main rival, WTI, or West Texas Intermediate. Both are major benchmarks in the oil market, but they have their differences. Brent is more global, while WTI is more focused on the U.S. market. Think of it like a boxing match between two heavyweight champions. Each has its own strengths and weaknesses, and understanding these differences can help you make smarter investment decisions.

Key Differences Between Brent and WTI

- Brent is produced in the North Sea, while WTI is produced in the U.S.

- Brent is more globally traded, while WTI is more U.S.-centric.

- Brent prices are influenced by global supply and demand, while WTI prices are more influenced by U.S. market conditions.

Brent Prices: What Influences Them?

So, what makes Brent prices move? Well, it's a complex mix of factors. Global supply and demand, geopolitical tensions, weather conditions, and even economic data can all influence Brent prices. It's like a giant puzzle with many pieces, and understanding how they fit together can give you a clearer picture of the energy market.

Read also:Alec Black The Untold Story Of A Rising Star In The Modern Era

Factors That Drive Brent Prices

- Global supply and demand dynamics

- Geopolitical events and tensions

- Weather conditions, such as hurricanes in the Gulf of Mexico

- Economic data, like GDP growth rates and employment figures

The Role of Brent in Global Markets

Brent crude oil plays a crucial role in the global economy. It's used as a benchmark for pricing crude oil contracts around the world, and its price movements can have a ripple effect across various industries. From transportation to manufacturing, Brent's influence is felt far and wide. It's like the backbone of the global energy market.

How Brent Affects You

Even if you're not directly involved in the energy industry, Brent can still affect your daily life. Higher Brent prices can lead to higher gas prices at the pump, which can impact your budget. It can also affect the cost of goods and services, as transportation costs rise. So, paying attention to Brent prices isn't just for traders and investors; it's for anyone who wants to understand the world around them.

Brent Futures: Trading in the Energy Market

If you're interested in trading, Brent futures contracts are a popular choice. They allow traders to speculate on the future price of Brent crude oil or hedge against price fluctuations. It's like placing a bet on where you think the market is headed. But remember, trading is risky, and it's important to do your research and understand the market before diving in.

Tips for Trading Brent Futures

- Stay informed about global events that could impact oil prices

- Use technical analysis to identify trends and patterns

- Set stop-loss orders to limit potential losses

- Stay disciplined and stick to your trading plan

Challenges Facing Brent

Like any commodity, Brent faces its share of challenges. The transition to renewable energy, geopolitical tensions, and market volatility can all impact Brent's future. It's like navigating a ship through stormy waters. But with the right strategies and insights, you can weather the storm and come out on top.

Future Trends in the Energy Market

- The rise of renewable energy sources

- Advancements in energy storage technology

- Increased focus on sustainability and environmental impact

Conclusion: Why Brent Matters to You

So, there you have it. Brent crude oil is more than just a name; it's a vital part of the global energy market. Whether you're an investor, a trader, or just someone curious about how the world works, understanding Brent can give you a deeper appreciation for the complexities of the energy industry. So, the next time you hear about Brent prices, remember that it's not just a number. It's a reflection of the global economy and the interconnectedness of our world.

And hey, if you found this article helpful, don't forget to leave a comment or share it with your friends. Knowledge is power, and the more people understand the energy market, the better equipped we all are to navigate the challenges and opportunities ahead. Until next time, stay informed and keep learning!

Table of Contents

- Brent Basics: What You Need to Know

- History of Brent: How It All Began

- Brent vs. WTI: The Battle of the Benchmarks

- Brent Prices: What Influences Them?

- The Role of Brent in Global Markets

- Brent Futures: Trading in the Energy Market

- Challenges Facing Brent

- Conclusion: Why Brent Matters to You